3 Excellent Info For Investing Your Savings in 2024

3 Excellent Info For Investing Your Savings in 2024

Blog Article

What Are The Best Strategies To Invest In The Stock Market In 2024?

The stock market can be explored in 2024 using a variety of strategies that are adapted to various investment objectives and risk tolerances. Diversified Index Funds (DIFs) and ETFs are among the top options to invest in this year in the stock market.

S&P 500 Index Funds Investing into funds that follow S&P 500 offers broad exposure to U.S. large-cap stocks and the ability to have a balanced risk-return profile.

Thematic ETFs. ETFs focused on new trends such as biotechnology and clean energy or artificial intelligence can help you capitalize on the growth of these sectors.

Dividend Stocks:

High-Yield Dividend Stocks that have a long history of consistently paying high and consistent dividends can provide steady income, especially in a volatile market.

Dividend Aristocrats are companies which have been increasing their dividends consistently for 25 years or more and have demonstrated financial stability.

Growth Stocks:

Tech giants. Apple, Microsoft, Amazon and many other businesses continue to demonstrate a strong growth potential due in part to their unique products and their dominant market position.

Emerging Technology Companies: While they are more risky, investing in smaller, innovative companies can provide significant growth potential.

International Stocks

Emerging Markets The economies of nations such as China as well as India are growing, which means they have opportunities for growth.

Developed Markets Diversifying into European and other developed markets can bring stability and increase growth when compared with established economies.

Sector-Specific Investments:

Technology continues to be one of the most significant sectors with its advancements in AI and cybersecurity.

Healthcare is a thriving industry, thanks to the aging population and the advancements in medicine.

Renewable Energy: As part of the shift towards sustainability across the globe, investments in wind, solar and other renewable energy sources are rising.

Value Investing

Stocks undervalued: Search for companies that have strong economics but which have a price that is below their intrinsic value. They offer significant potential profits if the market corrects them.

ESG (Environmental Social, and Governance) Investment:

Sustainable companies. Making investments in companies with ESG practices aligns with the values of your own. It can even lead to an increase in profit since sustainability is becoming more important to regulators and customers.

REITs (Real Estate Investment Trusts):

REITs for residential and commercial use provide exposure to real estate without owning actual properties. Dividends are paid and they have the potential for capital growth.

Options and derivatives

You can earn money selling covered call options, if you have stocks.

Purchase Puts to safeguard Your Stock: Buying put can help you protect against the possibility of a decline in price of your stocks.

Automated Investing and Robo-Advisors

Robo advisors: Platforms such as Betterment and Wealthfront are automated, algorithmic-driven financial planning platforms with diversified investment portfolios that are crafted to meet your goals and risk tolerance.

Other Tips for 2020

Stay Informed. Pay attention to market trends, economic indicator, and geopolitical event that could affect the stock market.

Long-Term Perspective: To ride out uncertainty, you must focus on long-term growth, not short-term gains.

Risk Management: Think about your risk tolerance in establishing your portfolio.

Review and rebalance regularly: Continually evaluate and rebalance the portfolio to ensure that you maintain your desired allocation of assets and are able to capitalize on market opportunities.

You can increase the value of the value of your investment in 2024 through combining these strategies and being flexible to market conditions. View the top rated Cross Finance url for blog info.

What Are The 10 Best Methods To Invest In Mutual Funds In 2024?

Mutual funds can be a great option to diversify your portfolio, gain professional management, and access various asset classes. Here are five strategies to invest mutual funds for 2024.

Broad Market Index Funds These funds are based on major indices, such as the S&P 500. Low fees and steady returns permit them to give exposure to a range of large U.S. stock companies.

International Index Funds. These funds track the performance of indexes that are based on foreign markets. This provides diversification, and offers exposure to global growth.

Sector-Specific Funds:

Technology Funds In investing in funds focused on companies in the tech sector and technology companies, you can reap the benefits of growth in areas like AI cybersecurity, cloud computing.

Healthcare Funds These funds put money into biotechnology, pharmaceutical medical devices, other companies. They are able to profit from the aging population and the advancements in medical technology.

Bond Funds

Government Bond Funds (GFF) The funds are invested in U.S. Treasury securities or other bonds issued by the government, which provide income and stability, especially in times of uncertainty.

Corporate Bond Funds Invest in bonds issued to corporations. These funds provide better yields than government bonds, but with more risk.

Municipal Bonds Funds They invest in bonds issued by local and state government. They offer tax-free income, making them appealing for those earning a high income.

Balanced funds:

Allocation Funds These funds comprise a mix of bonds, stocks and other assets. They result in a balanced and well-diversified portfolio that has the potential to grow and have moderate risk.

Target-Date Fonds: These funds created to help plan for retirement, will automatically alter their allocation of assets when the the target date gets closer.

ESG Funds

Sustainable Investing The funds focus on businesses that adhere to strong environmental, social and corporate governance practices. They are popular with investors who are socially conscious, and they could also benefit from the rising emphasis on sustainable investment.

International and Emerging markets funds:

Funds for Developed Markets: Investments in the markets of developed nations other than the U.S. can provide diversification and exposure to stable economies.

Emerging Market Funds (EMF) The funds are primarily invested in emerging countries and offer a higher potential for growth, but a higher risk due the political and economic instability.

Real Estate Funds:

REIT Funds Investing in mutual funds that invest in Real Estate Investment Trusts can give you access to the market without the need to own properties. You can also earn dividends and possibly gain capital appreciation.

Dividend Funds:

High-Yielding Funds: These funds invest in businesses that pay out high dividends. This creates a stable income stream and the possibility of capital appreciation.

Dividend-growth funds: These are businesses that have continuously increasing their dividends over the years, which shows strong financial standing and growth potential.

Mid-Cap and Small-Cap Funds:

Small-Cap Funds investing in small-sized companies has a great potential for growth, however it comes with a higher level of risk and volatility.

Mid-Cap Funds These funds invest in mid-sized companies and balance their growth potential with stability.

Alternative Investment Funds

Commodities Funds. These funds are primarily invested in commodities, including silver, gold, and. This is a great way to protect against inflation or economic downturns.

Hedge Fund Replication Funds are mutual funds that mimic the strategies of hedge funds and offer sophisticated strategies for investment at lower costs.

The Year 2024: Additional Tips

Pay attention to mutual fund fees. Lowering expense ratios will improve the return on investments that are long-term.

Diversification - Spread the risk of your investment over various funds to maximize the potential return.

Performance History: Look at the performance history of the funds, but be aware that past performance isn't indicative of future results.

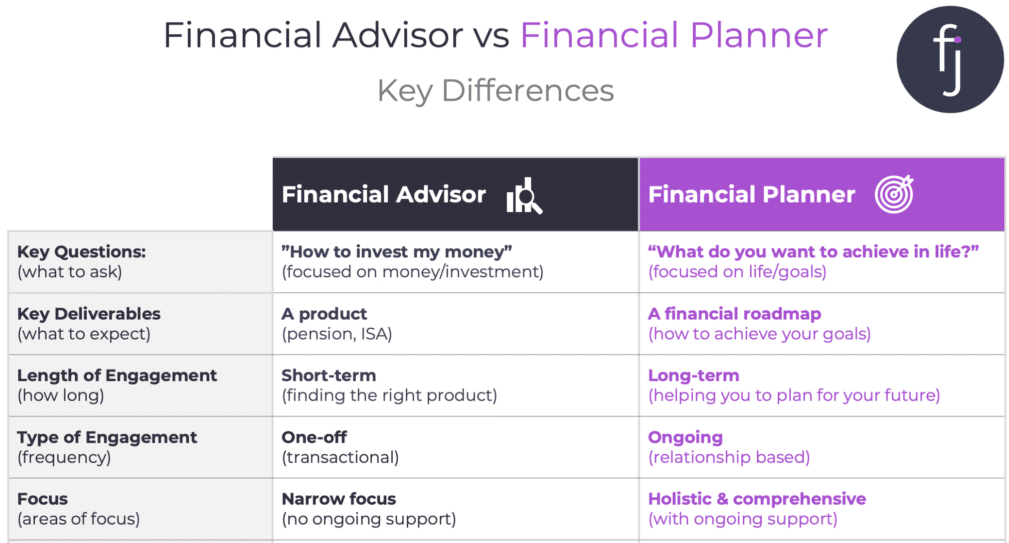

Professional Advice: Talk to an advisor in the field of financial planning about making your mutual funds investments to meet your goals in finance, your risk tolerance and your time to maturity.

Automated Investment Plans - A lot of mutual funds offer plans that let you invest frequently. You can make use of dollar cost averaging, and your investment will grow with time.

If you choose mutual funds that align with your investment strategy, and being aware of market's conditions, you can maximize your mutual-fund investments before 2024.

What are the Top 10 Methods to Invest in Peer to Peer Lending in 2024?

Peer-to-peer lending can yield attractive returns while diversifying your portfolio. Here are the best ways to invest on P2P lending in 2024.

1. Reputable P2P Platforms

Platforms to Research: Choose reliable, well-established P2P platforms like LendingClub Prosper and Upstart. These platforms have an established track record and solid screening procedures for borrowers.

You should consider diversifying your platforms to spread risk and improve returns.

2. Diversify your investments

Spread Across loans: Diversify your portfolio by spreading your funds over many different loans rather than investing a significant amount into one loan. This will reduce the chance of default.

Variable grade of loans: Investing in loans that have different risk ratings (e.g. low-grade, medium grade and high grade) can help you to balance your potential return and the risk.

3. Automated investment tools

Auto-Invest has features: P2P platform auto-invest tools will automatically place your money into investments that meet your investment requirements. They can also be utilized to diversify and invest your money.

4. Concentrate on Credit Quality

Analyze the Borrower Data: Evaluate the likelihood of borrowers being able to repay loans by studying their profiles as borrower, which includes their credit scores, income levels and job status.

Risk Assessment: Prioritize loans that have better credit ratings in order to reduce the risk of default, even if it means accepting slightly lower returns.

5. Reinvest Earnings

Compound Returns - Reinvesting the interest and principal repayments will multiply your returns and maximize the potential growth of your investment over time.

6. You can monitor and adjust your portfolio

Regularly review your portfolio on a regular basis to ensure it's compatible with your financial objectives, and your tolerance for risk. Adjust your portfolio as necessary according to current market conditions and the performance.

Performance Metrics Track key performance indicators such as default rate, net return and cashflow, to make educated decisions.

7. Understanding Platform Fees

Fee Structures - Be aware of the fees charged by platforms, such as service fees, origination charges or administrative charges. Lower fees could boost the net profits you earn.

8. Take a look at secondary Markets

Liquidity Options: Certain P2P platforms provide secondary markets, where you can purchase and sell loans, thereby providing more liquidity, and also the possibility to modify your portfolio more easily.

9. Regulations are important.

Compliance and Regulations: P2P loans are subject to regulatory changes. Be aware of current regulations and upcoming changes that could impact the P2P lending environment.

10. Risk Management Strategies

Make sure to keep an emergency fund distinct from your P2P investments to guarantee financial stability.

Limit exposure : Limit P2P Lending to a certain portion of the overall investment portfolio. This will ensure diversification between various types of assets.

Additional Tips for 2024

Conduct thorough due diligence:

Market Research: Find out the size of the market and the potential of it. Also, establish the level of competition.

Management Team - Review the team's record skills, experience and knowledge.

Financial Projections Examine the health of the business's finances and forecasts. the company.

Diversify Your Portfolio:

Diversify your investments across startups, industries and growth stages to lower risk and maximize your potential return.

Be aware of the risks:

Be aware of the risks involved in investing in private equity, startups and venture capital. You may be unable to recover your entire investment. This class of investment should not be a large portion of your portfolio.

Expertise in Leveraging and Networking:

Develop relationships with venture capitalists and other industry experts to gain valuable insight and to access high-quality investments.

Keep informed about current trends:

Keep up-to-date with current developments in technology, industry and economic trends.

Compliance with the law and regulations:

Be sure that your investments are compliant with the legal and regulatory rules and regulations. Consult with legal and financial experts to understand the complexities of private investment.

Exit Strategy:

Knowing your exit strategy for investments is essential, whether you are planning to sell, merge and acquire, or do secondary sales.

If you follow these methods and staying well-informed by these strategies, you can make smart investments in private equity or startups. You will be able to balance the high potential return with prudent risk control by 2024.